The Bipartisan Budget Act of 2015 Forces Seniors to Rethink Social Security Filing Strategies

Make sure you do not miss the April 29, 2016 deadline for filing!

Written by Lou Ottati, CFP®, Certified Financial Planner, SFSG

Recent changes to Social Security made in the Bipartisan Budget Act of 2015 include elimination of both the “File and Suspend” and “Restricted Application” options.

The new budget bill that President Obama signed on November 2, 2015 unexpectedly included significant changes to Social Security, including eliminating two popular Social Security “claiming strategies” that have been used by seniors since 2000 to maximize Social Security benefits. These changes are a small part of the overall budget bill, which in its entirety is frequently seen as “a big, big gain for older Americans” as expressed by one AARP reviewer. This positive view of the overall bill is taking hold because the bill includes what many see as a number of “sensible compromises,” especially when it comes to retirement security, coming out of a Congress frequently unable to compromise. The bill:

- Eliminates filing strategies that were seen as “unintended loopholes” benefiting wealthier seniors only. The Center for Retirement Research at Boston College estimated that these strategies cost the government roughly $10 billion annually.

- Curbs the potentially huge Medicare Part B premium increases. (Premium increases of up to 52% had been discussed.)

- Shores up Social Security Disability Insurance, avoiding a potential 20% cut in benefits.

The budget deal is now law, giving policymakers time to consider longer term fixes to Social Security and Medicare. Skeptics doubted that such a deal could be reached, and many more still question whether substantive reform will ultimately pass the Congress. However, the deal at least provides some time for developing to develop viable reform measures.

What follows is an overview of the two popular filing strategies that were eliminated by the Budget Bill.

- The File and Suspend Strategy

The Senior Citizens’ Freedom to Work Act was signed into law in 2000 by President Clinton. The primary purpose of the law was to allow seniors to continue working while receiving Social Security benefits without losing any of those benefits. The law also gave seniors the opportunity to suspend their current benefits in order to earn a Delayed Retirement Credit or DRC at age 70 by implementing a File and Suspend strategy. However, a secondary strategy soon emerged in which married couples used File and Suspend to allow one spouse to start claiming spousal benefits at their Full Retirement Age (FRA)[1] while the other spouse delayed their benefit, allowing it to continue growing to its maximum amount at age 70. It is this secondary strategy that is seen as the “unintended loophole.”

For individuals, there was a similar option. At FRA, an individual who wanted to delay their Social Security benefits until age 70 could also choose to File and Suspend. According to Michael Kitces[2], he or she would earn the same DRCs that would accrue by just delaying outright, but by “filing and suspending”, the individual could have a change of mind and “it would be possible to retroactively claim all benefits going back to the date of the original suspension.”

The Budget Act effectively ends the File and Suspend option six months after the date of passage of the Budget Act. The good news is that if you reach your FRA by April 29, 2016, you can still apply for File and Suspend. Individuals who are already using this strategy will be grandfathered in until they reach age 70.

- The Restricted Application Strategy or “Claim Now, Claim More Later”

While File and Suspend allowed someone else to get spousal benefits while the primary worker delayed his/her own benefit, the purpose of the Restricted Application strategy was for someone to get their own spousal benefit while delaying their own individual retirement benefit. Using this strategy, an individual would collect a spousal benefit once they reach FRA and then collect a higher benefit, by earning DRCs, once they reach age 70. Hence the “claim now, claim more later” description.

The Budget Act of 2015 ends this strategy for anyone born January 2, 1954 or later. For those who turn 62 or older this year (born January 1, 1954 or earlier), the Restricted Application strategy is still available even if their filing for benefits does not happen until 2019, when today’s 62 year olds finally reach their FRA.

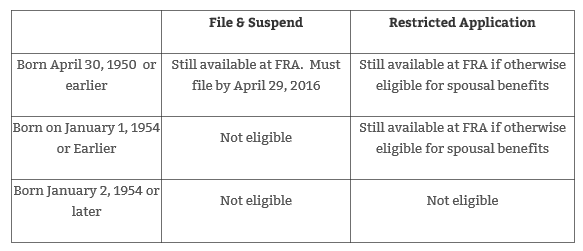

Please refer to Michael Kitces’ chart[3] below for a summary of who is impacted and when.

- The Impact of the Budget Act on Divorced/Ex-Spouse Benefits/Survivor Benefits/Lump-Sum Retroactive Distribution

- Divorced/Ex-Spouse Benefits

- For divorced spouses, File and Suspend was not relevant since the divorced spouse is eligible for a full spousal benefit at FRA as long as his/her ex-spouse is at least age 62 (regardless of whether that person has filed for benefits).

- The Restricted Application for ex-spouse spousal benefits while delaying one’s individual benefit was an effective strategy. Unfortunately, this strategy is no longer available under Budget Act for those born January 2, 1954 or later. For those born January 1, 1954 or earlier, the Restricted Application remains available under the new rules.

- Survivor Benefits (Including Divorcee Survivors)

- The Budget Act does not impact survivor benefits, leaving all previously available options and rules in place for survivors.

- Lump-Sum Retroactive Distribution

- The option to implement a File and Suspend strategy to earn DRCs and subsequently change one’s mind has been eliminated by the Budget Act. One can no longer request a retroactive lump-sum payment of all benefits going back to the date benefits were originally suspended.

- On the positive side, anyone born April 30, 1950 or earlier who reaches FRA and completes File and Suspend by April 29, 2016 will still be eligible to change their mind and request a lump-sum payment.

Please call our office at 732-739-8991 with any questions you may have on this subject.

Sources

- Kitces, Michael; Navigating the Effective Date Deadlines for the New File-and-Suspend and Restricted Application Rules; Kitces.com; November 13, 2015

- Schoeff, Mark Jr.; Social Security Wreaking Havoc with Advisors; Investment News, November 2 – 6, 2015

- Holland, Kelley; What the Budget Deal Means for Retirees; CNBC/Personal Finance; November 4, 2015

[1] Full Retirement Age depends on year of birth. For those born 1943 through 1954, FRA is 66.

[2] Michael Kitces “Navigating the Effective Date Deadlines for the New File and Suspend and Restricted Application Deadlines”;

Kitces.com November 13, 2015.

[3] Michael Kitces “Navigating the Effective Date Deadlines for the New File and Suspend and Restricted Application Deadlines;”

Kitces.com November 13, 2015.

H.R.1314 - Bipartisan Budget Act of 2015

Read full act at https://www.congress.gov/bill/114th-congress/house-bill/1314/text#toc-H2...