There is a saying that the only unavoidable things in life are death and taxes. One might argue that Medicare should be included on that list. All of us, once we turn 65, or before if there are extenuating circumstances, will be eligible for, and required to apply for Medicare.

Administered by the federal government since 1966, it provides medical coverage through approximately 30 private insurance companies across the U.S. As a federally administered program, it is constantly changing due to political and budgetary circumstances making Medicare an evolving effort. Recently, Lou Ottati, CFP®, a Financial Planner in our office, attended several seminars on this subject and put together some basic facts and updates to assist in clarifying the current state of affairs. As always, should you have any questions or concerns please do not hesitate to contact us at 732-739-8991.

- Open enrollment for Medicare began on October 15, 2015 and ends on December 7, 2015. During this period, Medicare participants can switch their coverage to any plan offered.

- Anyone turning 65 must sign up for Medicare within a seven-month period:

- three months prior to one’s birth month

- during one’s birth month

- three months after one’s birth month

- Failure to sign up within the seven month time frame will result in paying a premium penalty. The premium penalty for Part B is 10% per year and 12% per year for Part D. If you sign up two years late, the Part A and D premiums are 20% and 24%, respectively. These are not one year premium increases but rather lifelong penalties!

- Virtually all (90 – 95%) Medicare participants overspend on Medicare.

- You should shop for Medicare coverage every year.

- Do not wait until the last minute to shop.

- Do not assume there isn’t anything better than what you have currently .

- Pay particular attention if:

- Your medications have changed.

- Your out-of-pocket costs are high.

- The customer service is poor.

- You are uncomfortable with premium increases.

- Your insurance plan has been discontinued.

- Medicare premiums are based on one’s income. As your Medicare Modified Adjusted Gross Income (MAGI) goes up, your Medicare premiums increase - both Part B and Part D premiums.

- The Modified Adjusted Gross Income is calculated as follows:

- MAGI = Adjusted Gross Income (AGI) + Tax Exempt Interest

- The income used is 2 years in arrears, i.e., 2015 Medicare premiums are based on one’s 2013 tax return.

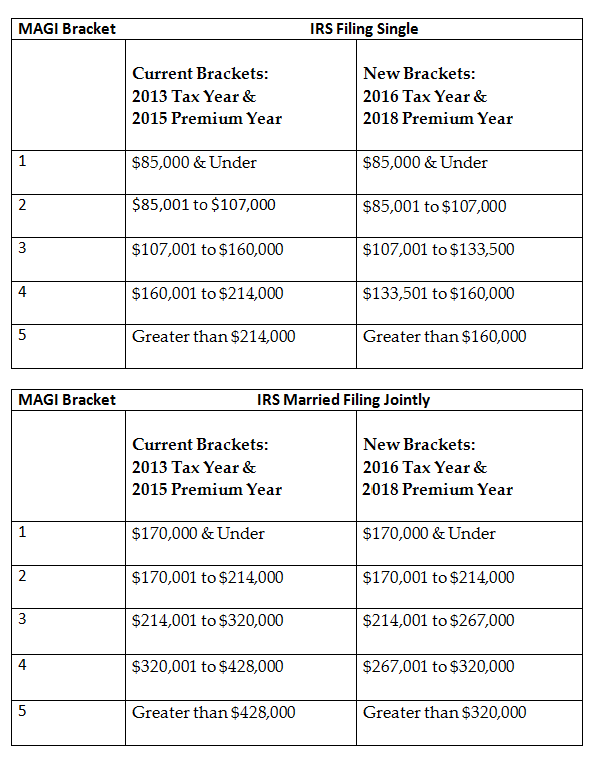

- There will be significant increases to 2018 Medicare premiums (based on one’s 2016 tax return filed in 2017). Higher income individuals and couples will find themselves paying the increased premiums for Parts B and D as income brackets are dramatically reduced. In addition to the changes slated for 2018, there will be increases in Medicare premiums for 2016 but as of this publishing date, the Social Security Administration has not yet announced what the new premiums will be.

- See below for 2015 vs. 2018 income brackets for singles and married couples.

Sources:

1. “What You Don’t Know About Medicare That Could Wreck Your Client’s Retirement”, Presentation by Dr. Kay Votava, President, Goodcare.com 2. “When Social Security Benefits and Medicare Premiums Collide”, Mark Miller, Morningstar.com, October 26, 2015